Legal documentation is a process that many people try to get around. Some businesses like to take shortcuts and can rely on illegal ways to be ahead of their competitors.

One of those illegal ways is escaping taxes. These taxes ensure that some money is paid back to the government in exchange for all the facilities it provided for a business to start. These taxes are often measured in percentages.

Large businesses will have to pay more significant taxes, which is why some of them might attempt to tamper with the legitimacy of their VAT numbers to escape such tax payments.

In this article, we’ll show you the best method for VAT verification in the UAE.

Table of Contents

What Is VAT in the UAE?

Value Added Tax (VAT) in the UAE is an extra payment on the consumption or purchase of various goods. It was introduced recently in 2018 to reduce the country’s reliance on oil and improve the country’s revenue using other methods.

All businesses in the UAE must register their companies for VAT and follow all the necessary rules and regulations.

Needless to say, a key aspect of VAT compliance is verifying the validity of this VAT registration number.

How to Perform VAT Verification in UAE?

Here’s how to verify VAT in the UAE:

1. Obtain the VAT Registration Number

Before verifying a business VAT, you need to obtain it first. That’s not a phone number you can quickly browse online and find. It’s a unique identifying serial for each registered business.

You can obtain that VAT number using several ways. One of these methods is checking the company’s documents, like invoices and receipts. You may also search the FTA database.

Alternatively, you may contact the company or its accountant if you’re eligible to request the VAT number. You may also try online databases like Lusha and Zoominfo.

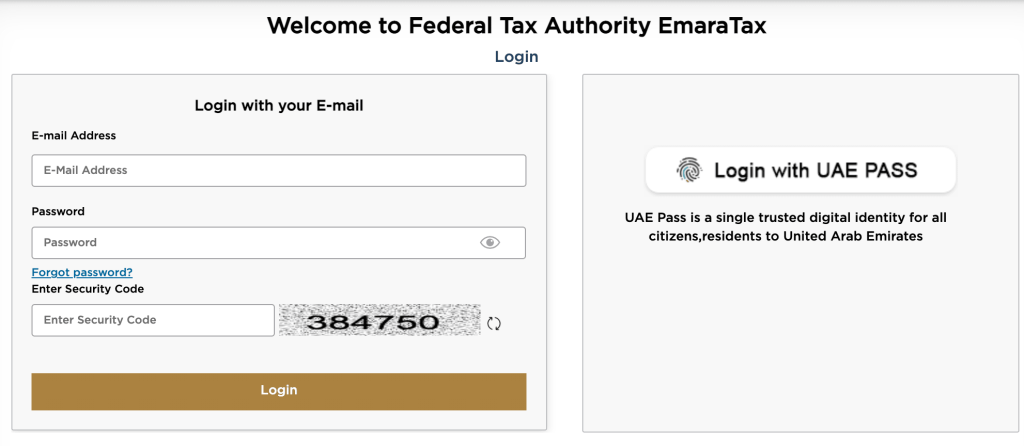

2. Use the FTA Online Portal

Once you obtain the required VAT number, you should sign in to the FTA’s official website. After signing in, navigate to the “services” tab, then select “E-services” and then “Tax Registration.”

You’ll be asked to enter the VAT number in the appropriate field. Carefully enter the number and complete the “are you a human?” prompt if it shows up.

Keep in mind that the FTA only allows businesses to check the VAT registration status of others. You won’t be able to do that if you don’t own an already verified business.

3. Check the Registration Status

At this point, you should know whether the number you entered is valid. If the VAT registration number is indeed legitimate, the screen will display the name of the business, the date of registration, and the current registered address.

However, if the registration number isn’t valid, the portal will show you an error message that says: “The registration number is not recognized.”

This doesn’t always mean that the business is fraudulent. You could have made a mistake.

Ensure you’ve entered the correct number, as an incorrect VAT number will also display the same message.

4. Verify Additional Details

You can view some extra details if the registration number is valid. Simply click on the “view details” button on the portal. It will show you a summary of the business’s information.

This information includes but isn’t limited to registration information, certificates, and tax periods.

Why Is VAT Verification Important?

Fair competition is a goal that any government would do its best to apply, and the UAE is no different. Taxes will undoubtedly put some drag on the economy of a business, so it’s common for some of these businesses to try to avoid it.

VAT verification allows businesses to check the legitimacy of each other. There will be far fewer chances of fraud when every business has its cards laid out in the open.

Businesses should always make use of the FTA’s knowledge portal to ensure that everyone is operating within the law in the UAE market.

If any business fails to register for VAT or gets caught bending the rules and regulations, it should expect severe penalization.

These penalties could be anything from bearable fines to stern legal actions and, sometimes, business terminations.

The Bottom Line

VAT verification in the UAE is essential for businesses to keep an eye on each other and ensure the fairest possible competition.

To verify the VAT registration number of a business, you first need to get your hand on its VAT number. You can find it in the business’s invoices, receipts, and legal documents.

Once you obtain the number, sign in with your business credentials through the FTA portal’s official website, then navigate to the tax registration tab. From there, you can verify the status of the business’ VAT registration, as well as certifications, and tax periods.